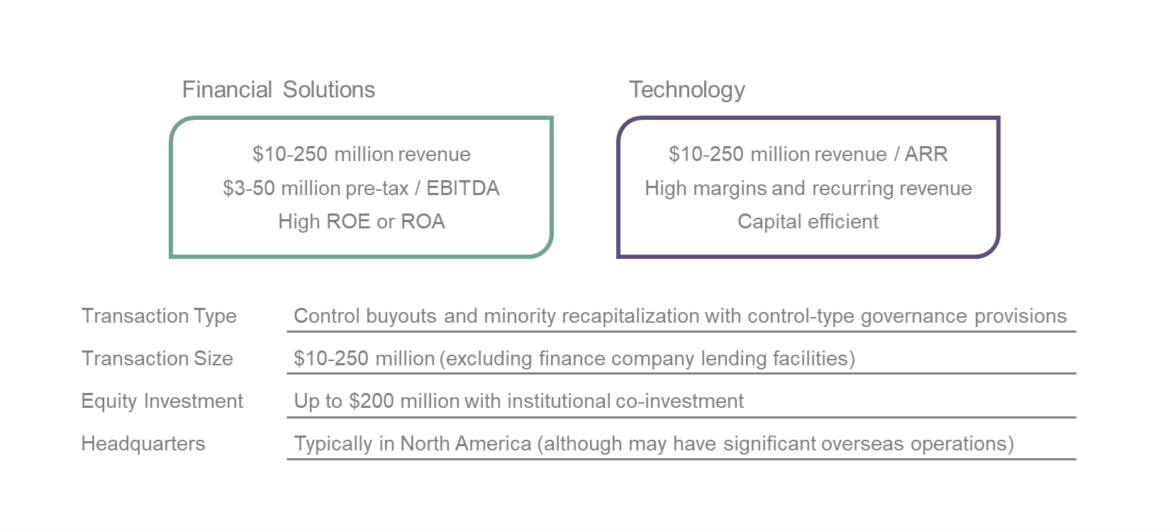

Milestone Partners specializes in making control equity investments in two industry segments: financial solutions and technology. We invest in growing companies headquartered in North America where we believe we can apply our industry expertise and operating resources to accelerate growth and generate positive outcomes for our management teams and limited partners.

Financial/Operating Metrics:

Add-on Investments:

- We seek to support all of our platform companies with capital and resources for add-on acquisitions

- No size minimum

We value our intermediary partners.

- Members of our team are former investment bankers and we appreciate the value of the intermediary. Our goal is to be a good partner in the process, win or lose. You will find us respectful and responsive — we listen